Financing Options

When purchasing a spray rig, some customers choose to finance their new equipment.

A few options exist when it comes to getting a loan for spray rigs:

-

- Our most recommended option is an equipment financing company. Depending on the terms of the deal, you may be able to get 100% financing. AST works with Navitas Credit Corp to connect customers with financing opportunities, though other options do exist if you choose. To apply for financing with Navitas, click the Apply Today button below (please note that this button will take you away from www.sprayrig.com and to an external website).

- Your bank likely offers equipment financing. Since you are already banking with them, this creates a convenient one stop shop for all of your financial dealings. The challenge here is getting approval as banks often have stricter guidelines about who they will lend money to than other sources.

- A local drywall supply house might finance equipment. If you have a relationship with a supplier and they sell our equipment (For example: Sherwin-Williams, Ames, Hallman-Lindsay), it is possible that they offer payment plan options. Check with your local store.

As always, we are available to answer any questions and to help guide you through the process. Call 877-833-4342 or text 253-833-4342 to speak with someone that can help! Para español, favor de llamar 877-833-4342 o textear 253-833-4342 y pregunten por Ruben.

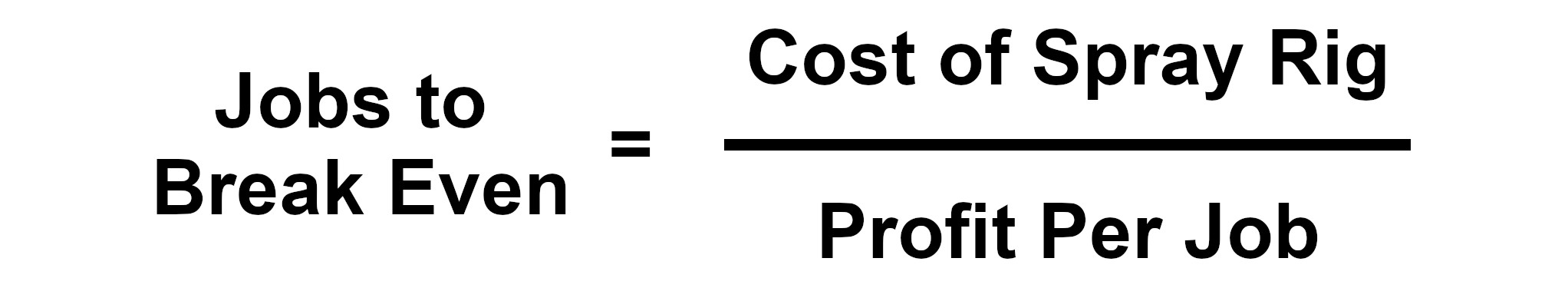

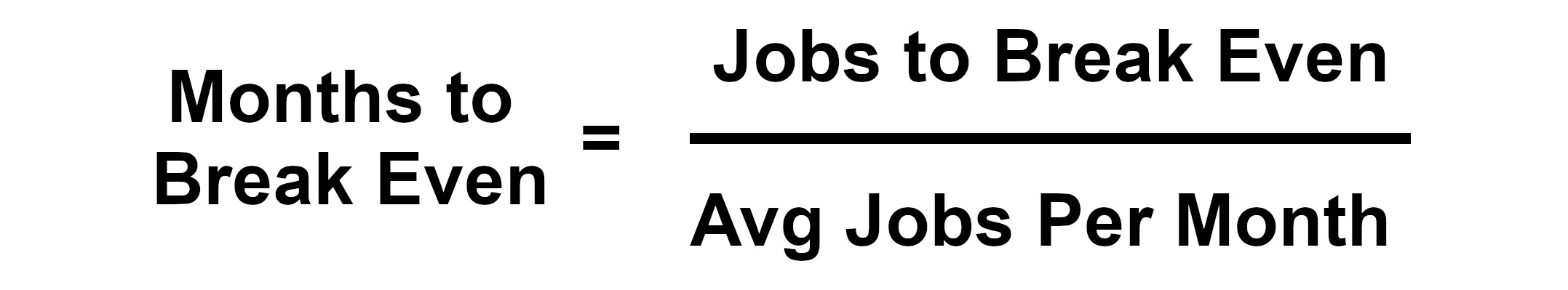

Spray Rig Breakeven Calculator

When you are thinking about purchasing a new texture machine, one helpful piece of information is the breakeven point of your investment. Another way of looking at this is how long it will take for your spray rig to pay for itself.

We can calculate this number if we know your average profit per job and the average number of jobs you spray per month. Your profit per job is the money you walk away with after paying for all the expenses for the job including labor and materials.

Don’t worry if you don’t know the exact numbers. You can plug estimates into the calculator and it will still give you a reasonable idea of how long it will take your business to break even on your spray rig.

This is an important calculation to do when purchasing capital equipment. At the end of the day, the purpose of the equipment is to produce profits for your business. Your breakeven timeline calculation will tell you when your spray rig will have produced more money than it cost so you can make a more informed decision about your purchase.